Blogs

- Stimuli fee December 2025, Internal revenue service direct deposit rescue payment & tariff bonus truth look at

- $2,one hundred thousand Last Stimuli Inspections 2025 – Qualifications Criteria & Fee Plan

- Disabled Survivors

- Veterans’ Financial Term life insurance (VMLI)

- Experts Fitness Administration (VHA)

Cost, Bundles, and you may Certified Web site to your Donald Trump Survivor Silver Money Even if the fresh coin’s sturdy construction ensures resilience, worry extends its excellence and cost in your private collection. From a safety viewpoint, loan companies are encouraged to continue the collectibles inside the safe, temperature-controlled environments, away from moisture and you will direct sunlight. To own loan companies who would like to display the new money, having fun with a great Uv-protected acrylic sit or shut shadow field can enhance its visibility while keeping the condition.

Stimuli fee December 2025, Internal revenue service direct deposit rescue payment & tariff bonus truth look at

- Please make them repeat suggestions otherwise slow down if you need to – they’re used to working with those people who are grieving and working with a lot of the fresh advice.

- I thought there is a get older needs or if you must end up being taking care of college students under 16.

- She and inspections container 2 for QCD on the web 4c to help you suggest a professional charitable shipping.

- TAS facilitate taxpayers care for issues with the brand new Internal revenue service, makes management and you will legislative advice to prevent or right the difficulties, and protects taxpayer legal rights.

- My hubby came to be for the 17th, thus i can get payment to the third Wednesday.

Utilize this dining table around of your user’s demise when the the proprietor passed away following expected birth time and this refers to the newest desk that would have been used had they perhaps not passed away. Explore Desk III when you are the new IRA manager plus companion isn’t the only real appointed recipient or if your lady ‘s the just appointed beneficiary of your IRA rather than more ten years young than simply you. Make use of this table and way for calculating the brand new relevant denominator in the the year of one’s user’s death if your manager passed away just after the required birth day referring to the new table who would have been used had they not passed away. This would be the number located in the row and you can line combination with each other your actual age by their birthday and your spouse’s ages by its birthday celebration in the 2026. Explore Table II when you are the fresh IRA owner along with your mate is both your sole designated beneficiary and more than 10 ages more youthful than your. Reduce your applicable denominator by the you to for each and every 12 months pursuing the season their withdrawals begin.

The new recipient can take the newest deduction to your taxation year the new earnings is actually stated. By taking distributions from one another a genetic IRA and your IRA, and every has base, you need to done separate Versions 8606 to search for the taxable and nontaxable servings ones distributions. While we can also be’t work in person every single review acquired, we create https://playcasinoonline.ca/wild-zone-slot-online-review/ appreciate their viewpoints and will consider your statements and you can suggestions even as we update the income tax versions, instructions, and you will books. A keen IRA is your own savings bundle that gives your taxation advantages of putting away money to possess old age. So it guide discusses distributions of private old age arrangements (IRAs). Distributions away from retirement agreements apart from 401(a), 403(a), 403(b), or 457(b) plans, or IRAs, are part of net funding income.Discover Form 8960, Web Money Income tax—People, Locations, and Trusts, and its particular recommendations for more information.

The brand new survivor annuity to possess a former partner who’s named as the out of a judge acquisition ends if your regards to the fresh court purchase try fulfilled. Such as, when the a great remarriage took place April, benefits manage prevent to your March 31. While you are hitched after you retire therefore selected not to render a great spousal survivor work for, you ought to obtain your own spouse’s accept the brand new election. The amount of money from a kid can affect some types of son advantages. The appropriate application to own passing advantages beneath the CSRS or FERS must be submitted which have an original signature so you can OPM.

The brand new Internal revenue service spends the fresh encoding technical to ensure the fresh electronic repayments you create on the web, by the cellular telephone, otherwise away from a mobile device utilizing the IRS2Go software is actually safe and you may secure. Costs away from U.S. income tax need to be remitted on the Irs within the U.S. bucks. Reporting and you can fixing your income tax-associated identity theft points.

$2,one hundred thousand Last Stimuli Inspections 2025 – Qualifications Criteria & Fee Plan

I experienced the newest survivor professionals software techniques from the six months ago, and i want to echo what anybody else have said – don’t be concerned on the establishing lead deposit ahead. I hadn’t experienced they’d inquire about company professionals, but i have a little your retirement away from their jobs one to I ought to has information regarding. It will not lower your survivor professionals, however they need to know because of their details. Either sadness brain makes us disregard amounts we’ve noted for ages.One thing that surprised me try they asked about any pros I would personally end up being choosing away from his boss (including your retirement otherwise insurance). We went through the newest survivor advantages process on the eighteen months in the past and wished to express a number of a lot more resources you to forced me to. There are also benefits to have unmarried pupils under 18 (otherwise 19 in the event the nonetheless inside twelfth grade), and in some cases, dependent moms and dads and divorced spouses.

Beginning in mid-2026, you may also make the election on the internet at the trumpaccounts.gov. To open the new membership, a keen election have to be produced for the Irs Setting 4547, called just after Trump’s presidential conditions. Trump profile commonly but really available; but not, household who want to unlock you can start one to techniques now. The bucks will go for the another kid checking account for the kids below 18. Earlier this week, the brand new White Family — along with Michael Dell, creator and you will President of Dell Tech, and his partner, Susan — launched one of the largest contributions previously to profit Western people. You understand you could choose-out at any time.

Disabled Survivors

Condition pros to own Experts range between income tax exemptions, financial help, 100 percent free leisure permits, licenses plates, and. When you are there are various government possibilities and you may advantages to possess Pros away from teams, for every condition and U.S. region offers the form of advantages and you will rewards. These types of letters are crucial to have Vets to receive certain pros. You might found Veterans pros using direct put. Go out is not one thing and in case your sanctuary’t filed to own PTSD Seasoned professionals but can be considered, even when it’s been many years, Vets are encouraged to touch base.

Veterans’ Financial Term life insurance (VMLI)

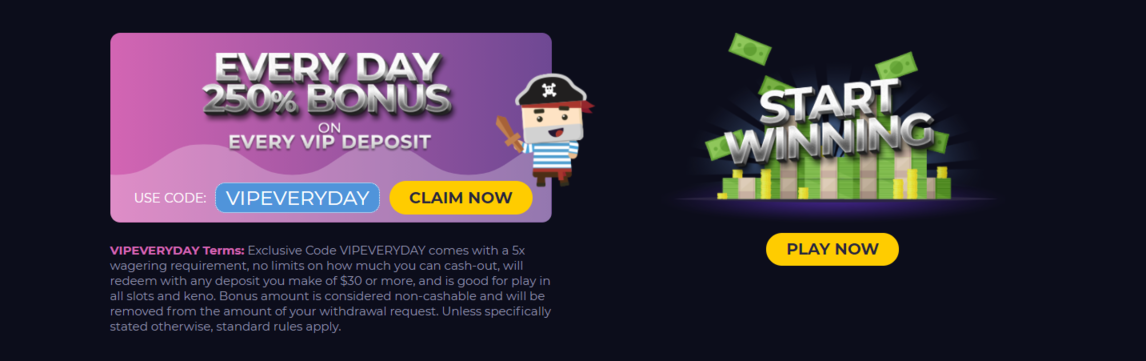

This tactic ensures that someone – out of very first-day buyers to knowledgeable collectors – can acquire a meaningful artifact as opposed to monetary barriers. While many commemorative gold coins merchandising ranging from $fifty and you can $100, 2A Defender offers the Donald Trump Survivor Silver Money for free, demanding simply a low distribution payment. For every coin is even encased to possess security, making sure they remains clean for decades instead dropping their perfection. Antique Trump collectibles have a tendency to focus on venture slogans otherwise patriotic photographs, which are preferred certainly one of general followers. Typically, the market for Trump collectibles is continuing to grow to add problem coins, framed portraits, campaign tokens, as well as uncommon signed items.

Experts Fitness Administration (VHA)

Generally retailing to own $forty two.97, it collectible is on offer because the a free of charge Render – you only defense a tiny you to definitely-time distribution and addressing payment. Extremely consumers receive their acquisition inside step 3-5 business days based on place. Per coin will come in the a protective obvious circumstances, so it is in a position to have display screen out of the field.

Recent Comments